Russia’s economic dilemma: Are higher oil prices a blessing or a curse?

A drilling rig at the Southern Priobskoye oil field of the Gazprom Neft.

Vladimir Smirnov/TASSWith world oil prices rising, the International Monetary Fund has marginally improved its forecast of the restoration of Russia's economy. According to the IMF, in 2016 the country's GDP will fall by 1.5 percent instead of the 1.8 percent earlier predicted. In turn, in 2017 Russia's economy will grow by 1 percent instead of 0.8 percent.

This is surely good news. However, it also raises concerns among a whole series of Russian politicians and economists. The growth of oil prices in Russia strengthens the national currency (against which the Central Bank is consistently taking measures) and drastically cheapens imports. Consequently, this creates a threat for exporters and makes production in Russia disadvantageous.

Moreover, the growth in oil prices threatens to stop the country from carrying out economic reforms, without which, in the view of many experts, the Russian economy will not be able to develop effectively.

Earlier, Central Bank Chairwoman Elvira Nabiullina remarked that even with a price of $100 a barrel Russia's GDP would be unable to grow by more than 1.5-2 percent if structural reforms are not implemented.

Benefits for the budget

"Soon we may see a unique situation on the oil market: the shortage of supply to satisfy demand," said Stanislav Verner, vice president of IFC Financial Center. In his words, unforeseeable circumstances are to blame: rebel activity in Colombia and Nigeria, the forest fires in Canada and the strike in Qatar.

As a result, during trading in Asia on April 20, North Sea Brent futures grew by 0.5 percent to $49.1 a barrel, meaning that the price has effectively reached the benchmark that the Russian budget is based on – $50 a barrel.

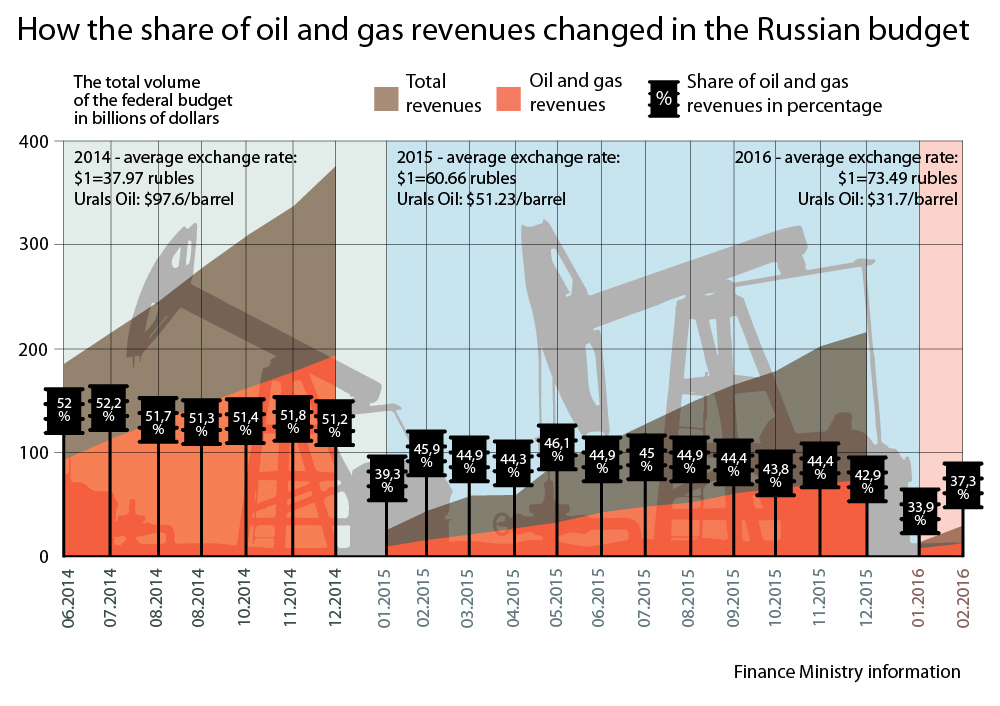

"The growing quotes on crude naturally have a positive effect on the Russian budget," said Semen Nemtsov, analyst at financial services company Russ Invest.

In comparison, with an average annual oil price of $40 a barrel the Russian budget deficit would be four percent of the country's GDP, Russian Economic Development Minister Alexei Ulyukayev recently said.

Also, when the ruble strengthens, import and tourism services cheapen. In May head of Rostourism Oleg Safonov said that Greece would be the most popular destination among Russian tourists in 2016. Despite its economic woes, the country remains within the eurozone and the ruble's recent rally against the euro makes travel to Greece more accessible for Russians.

Reforms may be canceled

However, increasing oil prices and a costlier ruble are not good news for everyone. The growth of the national currency puts domestic producers in a difficult position. In 2014, when the ruble was falling, the country implemented a program of import substitution.

The higher cost of imports gave Russian producers obvious advantages and they began to augment domestic production (hence in March 2015, when the ruble strengthened by 10 percent against the main international currencies, the Central Bank took measures to limit its further growth).

Moreover, the cheap ruble has paved the way for the potential reformation of Russia's economy and the development of Russia's own production.

Earlier, in an interview with RBTH, Vladimir May, one of the country's most authoritative economists and rector of the Russian Presidential Academy of National Economy and Public Administration, stated that low oil prices had given the Russian government an opportunity to carry out reforms in order to raise the economy's effectiveness and reduce its dependency on the sale of energy resources.

However, in the event prices for energy resources rise, the government may be tempted to shelve these ideas. A plan to postpone structural reforms from the economy has already been developed by President Vladimir Putin's advisors, wrote the Vedomosti business newspaper on May 20.

However, analysts do not expect a drastic increase in oil prices in the future.

"In the second half of the year we expect a decisive restoration of oil prices," said Bogdan Zvarich, an analyst at investment holding Finam. However, he added that by the end of the year the price of Brent will be around $50-55 a barrel.

Ivan Kapitonov, a professor at the Russian Presidential Academy of National Economy and Public Administration’s Higher School of Corporative Management, said it is unlikely Brent prices will exceed $50 a barrel.

Subscribe to get the hand picked best stories every week

All rights reserved by Rossiyskaya Gazeta.

Subscribe

to our newsletter!

Get the week's best stories straight to your inbox