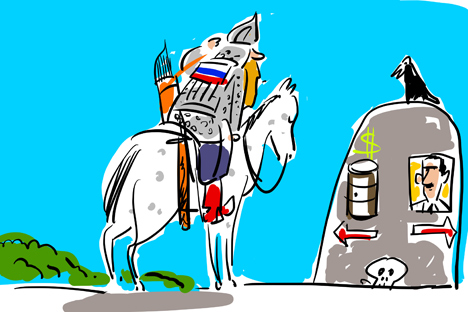

Click to enlarge the image. Drawing by Alexei Iorsh

Like any other war in the Middle East, the war in Syria has its economic background, because it is a war taking place in the region directly adjacent to the world's largest oil and gas fields; in the region, where multiple oil and gas pipelines are located or planned. Therefore, the war in Syria itself and Russia's involvement in it will inevitably create short- and long-term consequences for the country.

Syria itself is not a major player on the global hydrocarbon market. Even in the most prosperous years in the early 2000s, Syria was producing a little more than 520,000 barrels of oil per day, slightly more than 0.6 percent of world production.

Since the beginning of the civil war in Syria and the introduction of European sanctions, oil production in the country began to fall rapidly. By the beginning of this year, according to official statistics, it was a little over 30,000 barrels per day.

Gas production in Syria is also not large by world standards – about 5.5 billion cubic meters per year at present (compared to 9 billion cubic meters in 2010). In this context, we can safely say that no matter how war events unfold in Syria, no matter who wins the civil war, any development of the situation in the oil and gas industry in this country will not have a serious impact on the global oil market.

Much more serious economic consequences for Russia may be caused by its direct interference in the Syrian crisis. Although Russian officials claim that the Russian air force is bombing the positions of ISIS militants, numerous sources in the region say that the main target of these attacks is the "moderate" Syrian opposition fighting against the forces of Syrian President Bashar al-Assad.

Given that the key states in the region – Turkey and Saudi Arabia – support the Syrian Sunni opposition, then the longer and larger the Russian armed forces' involvement in the Syrian civil war, the more political and economic problems will arise for Russia in the region.

For example, the Russian Direct Investment Fund has announced the creation of investment partnerships with the sovereign wealth funds of Saudi Arabia and the United Arab Emirates. As part of these plans, these funds have expressed willingness to invest, respectively, $10 billion and $7 billion in projects in Russia.

In a situation in which western financial capital markets have effectively been closed to Russian banks and companies, the capital from the Gulf countries was considered by the Russian authorities as one of the possible and desirable alternatives. Obviously, in the case of a protracted military operation of the Russian army in Syria, the probability of the realization of these plans will fall sharply.

Turkey, due to its geographical position, is beginning to play a key role in the construction of transport infrastructure between Europe and Asia. By all appearances, the country will start the construction of several pipelines in the coming years, which would be able to deliver gas from Iran, Azerbaijan and Turkmenistan to Europe.

In addition, the pipelines may be laid to Turkey through Syria from Israel and Qatar. But if the Israeli project provides for the construction of the offshore gas pipeline outside the territorial waters of Turkey, the pipeline from Qatar must inevitably pass through Syria.

It is clear that as long as there is civil war in Syria, the construction of a gas pipeline on its territory is out of the question. In theory, this situation could be to the benefit of Gazprom, which is heavily promoting its Turkish Stream project, but is faced with serious constraints in access to the Turkish market and big problems in relations with its Turkish partners after lame statements by representatives of Gazprom on the active involvement of Greece.

However, Gazprom cannot seriously expect that the inability to get gas from Qatar will make Turkey softer in negotiations with the Russian company, since the country’s gas needs will be satisfied without restriction in any case.

In addition, it seems that the Qatari gas pipeline to Europe has already moved to the front of the line. To start a cost-effective supply of gas through Turkey, the ability to pump 15-20 billion cubic meters a year is needed, and that amount of gas is already there (Azerbaijan, Iran, Iraq, Turkmenistan) – these countries could increase production while the pipeline is being built.

As a result, the Russian military operation in Syria, in the short term, neither holds any significant losses (expenses) for Russia, nor promises any significant gains. At the same time, in the event of a more serious and long-term involvement in the civil war in Syria, Russia may face significant economic losses.

Sergey Alexashenko is a non-resident senior fellow at Brookings Institution (Washington D.C.) and served as the first deputy chairman of the Central Bank from 1995-1998.

All rights reserved by Rossiyskaya Gazeta.

Subscribe

to our newsletter!

Get the week's best stories straight to your inbox